FEDERAL STRANGLEHOLD: How Uncle Sam's Iron Grip is Choking Las Vegas' Land Dreams

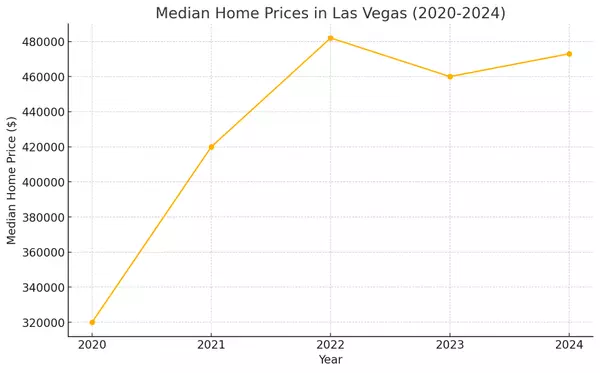

Audio Version - https://notebooklm.google.com/notebook/9ef2e39a-aa23-4039-9a6f-3c87f32f5e67/audio In a shocking revelation, top land developers are pointing fingers at the federal government as the primary culprit behind Las Vegas Valley's ongoing land crisis. The Bureau of Land Management (BLM) holds an unprecedented 88% of Clark County's land, the highest percentage in the nation, creating a unique and challenging situation for Nevada. The Federal Chokehold George Garcia, a veteran with over three decades in land planning and development, minces no words: "This is by far the dominant issue". He emphasizes that high-growth areas like Arizona and Texas don't face such constraints, allowing for unhindered expansion. The Numbers Game The Southern Nevada Public Land Management Act of 1998 earmarked approximately 67,000 acres out of 2.9 million for potential development. An additional 33,000 acres of smaller BLM parcels scattered throughout the county are also slated for disposal. Skyrocketing Prices The land shortage has sent prices soaring: Commercial land: Doubled in two years, now at $16.56 per square foot Residential properties: Jumped nearly 40% since 2020 Construction materials: Increased by about 40% since 2019 BLM's Response Theresa Coleman, district manager of the Southern Nevada District Office for the BLM, states that about 27,000 acres remain for disposal. Since 1998, nearly 44,000 acres have been disposed of through various means. The Supply-Demand Imbalance Brad Nelson, a seasoned development consultant, argues that the BLM is disrupting the fundamental economic principle of supply and demand. He points out that unlike other markets, Las Vegas builders can't acquire land at will due to the BLM auction process. Bureaucratic Hurdles Nelson highlights the numerous obstacles developers face: Land use plans Master plan amendments Various reports (grading, drainage, fiscal impact, etc.) Environmental reviews Architectural reviews Building permits Each step introduces delays and costs, further inflating project expenses. A Glimmer of Hope? U.S. Rep. Susie Lee's Accelerating Appraisals and Conservation Efforts Act, which recently passed the House, aims to streamline the appraisal process for valley land. Governor Joe Lombardo has endorsed this legislation.As Las Vegas grapples with this land crisis, the question remains: Can the federal grip be loosened to allow for sustainable growth, or will the valley continue to suffocate under bureaucratic red tape?

Dramatic Shifts in Las Vegas Rent: Where Prices Are Rising and Falling

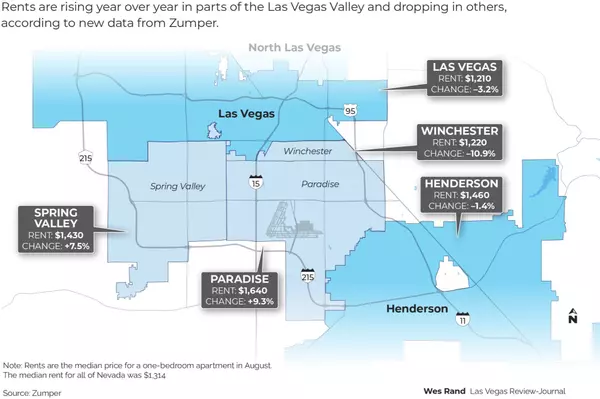

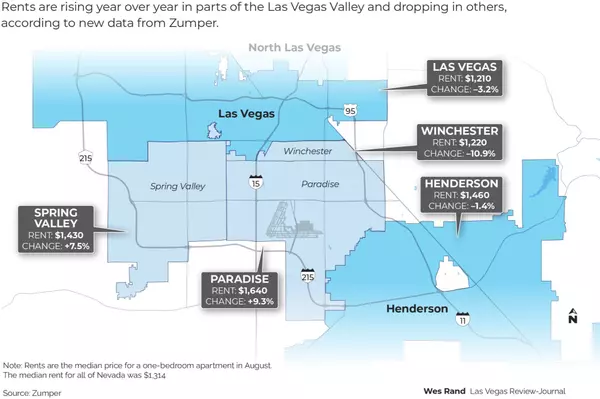

The Las Vegas rental market is a tale of two trends—some neighborhoods are seeing rising rents while others are witnessing a decline. But what does this mean for renters, and how does Las Vegas compare to the national market? A new study by Zumper reveals key insights that paint a complex picture of housing in the Las Vegas Valley, raising important questions about affordability, new developments, and what the future holds. Las Vegas Rental Prices: A City of Contrasts Las Vegas stands as the 67th most expensive city to rent in the U.S., according to Zumper’s recent analysis of 100 major cities. In August, the price of a one-bedroom apartment rose by 0.8% from the previous month, bringing the median price to $1,210. Meanwhile, two-bedroom rents stayed flat at $1,500. Although these numbers may seem modest, they illustrate a broader trend: Las Vegas rents are slowly creeping upward, even as some areas see declines. Comparatively, Las Vegas remains far more affordable than cities like New York, where the median rent for a one-bedroom apartment has surged to an eye-watering $4,500. Rental Price Trends Across the Las Vegas Valley: Winners and Losers Zumper’s report took a closer look at four key areas within the Las Vegas Valley: Henderson, Spring Valley, Winchester, and the city of Las Vegas itself. Winchester, for the purposes of this study, is defined as the area north of Paradise and south of the Arts District. Here’s how the median one-bedroom rents break down in each area: Paradise tops the list with the highest median rent at $1,640. Henderson comes in second with a median rent of $1,460. Spring Valley follows closely behind at $1,430. Winchester ranks fourth at $1,220. The city of Las Vegas rounds out the list with the lowest median rent at $1,210. Annual Price Changes: Paradise Soars, Winchester Declines When examining year-over-year changes, some areas have experienced significant price hikes, while others have seen a drop: Paradise saw the largest annual increase, with rents jumping 9.3%. Spring Valley followed with a 7.5% increase. Winchester experienced the steepest decline, with rents plummeting by 10.9%. The city of Las Vegas saw a more modest decrease of 3.2%. These contrasting trends raise the question: why are some areas seeing dramatic increases while others experience declines? Much of it has to do with local supply and demand dynamics, which are shifting as new developments hit the market. Las Vegas Rental Market Stability Amidst a National Boom Despite rising rents in some parts of Las Vegas, the overall market remains relatively affordable compared to national trends. Crystal Chen, associate director of communications for Zumper, noted that Las Vegas rents are approximately $300 cheaper than the national median. “It’s notable that Las Vegas rent is down annually since we are in the hot moving season right now,” Chen explained. Typically, this time of year sees heightened demand, but Las Vegas is bucking the trend. The Impact of New Developments on Rent Prices One reason for the relative stability in Las Vegas rental prices is the influx of new housing supply. “There is a generous amount of new supply hitting the Las Vegas market, and that is putting downward pressure on rent prices,” said Chen. In the next six months, nearly 6,000 new units will be delivered, and many new developments are offering incentives—such as waived fees, gift cards, and up to six weeks of free rent—to attract renters. This surge in new housing is likely why Las Vegas rent has remained stable, even during the typically busy summer months. Chen added that Zumper expects rental prices to remain stable or even decrease slightly as we head into the winter months, offering renters a potential reprieve. National Rental Trends: Defying Expectations On the national level, rental markets seem to be defying expectations. Zumper’s national rent index reports a 1.6% annual increase in median one-bedroom rents to $1,534, while two-bedroom rents are up 2.7% to $1,915. Despite a surge in new construction, the national vacancy rate has held steady at 6.6% over the past two quarters, according to Zumper CEO Anthemos Georgiades. “In an era where the amount of new supply is shattering records, it’s remarkable to see vacancy rates holding steady this year,” Georgiades said. “Strong renter retention alongside our growing national rent index underscores the robust demand present in the U.S. market.” Construction Boom Stabilizes Rents Across the Sun Belt A new report from Redfin mirrors Zumper’s findings, with the nationwide rental rate rising by 0.9% year-over-year. Redfin senior economist Sheharyar Bokhari explained that this marks the largest annual increase since April 2023, but overall rental affordability has improved compared to the all-time highs seen two years ago. Bokhari attributed this to the construction boom, particularly in Sun Belt states like Nevada, which has helped stabilize rent prices. “Almost everything in our lives costs more than it did two years ago, but rents have remained largely stable thanks to the construction boom,” Bokhari said. “We are seeing rents tick up a little now that new construction is starting to slow down, but asking rents are likely to stay relatively flat for some time due to the backlog of new apartments that are still coming onto the market.” The Future of Las Vegas Rentals: Stability Amid Uncertainty As we look toward the future, the Las Vegas rental market appears poised for a period of relative stability. With thousands of new units coming online and ongoing construction projects, renters may find themselves with more options and potentially lower prices in the coming months. However, as demand ebbs and flows, and construction rates adjust, the market remains uncertain. For now, the key takeaway is that renters in Las Vegas are experiencing a market in flux—some areas see prices rise, while others offer opportunities for savings. The challenge, as always, is finding the right place at the right time. Conclusion: Navigating the Changing Las Vegas Rental Landscape The Las Vegas rental market is a microcosm of the broader national trends. While some neighborhoods are seeing rent increases, others are becoming more affordable, driven by a surge in new housing developments. As the city continues to grow and evolve, renters should stay informed about the latest trends and take advantage of the unique opportunities that arise. Whether you're looking for stability or affordability, Las Vegas offers a bit of both, but the future remains an open question. Stay ahead of the curve, and you might just find the perfect place to call home.

Sellers Shake Up Real Estate: Buyer Agent Fees Under Fire in Hot Markets!

In an evolving real estate landscape, the age-old question of agent compensation has taken center stage, with sellers and agents navigating shifting tides in commission negotiations. A recent report from Redfin sheds light on the growing complexity surrounding buyer agent fees, where market dynamics play a critical role in determining compensation. As some regions continue business as usual, others see sellers pushing the boundaries on how much they're willing to pay — and whether they’ll pay at all. A Tale of Two Markets: Business as Usual or a New Era of Negotiation? Real estate markets across the U.S. are revealing stark contrasts. According to Redfin’s Chief Economist Daryl Fairweather, agents are seeing a divide between regions with sluggish demand and those experiencing a frenzy of competition. “In slower markets, sellers are still generally covering the buyer's agent commission to attract interest,” Fairweather stated, emphasizing that in these areas, agent fees remain largely unchanged. However, in hotbeds like San Francisco and Boston, where inventory is scarce and buyers are clamoring for properties, a new trend is emerging: sellers are increasingly negotiating these fees, asking buyers to come to the table with their best offer rather than pre-determining commission payouts. This shift in more competitive areas suggests a growing perception among sellers that buyer-side compensation is just another bargaining chip, much like inspection contingencies or earnest money deposits. Sellers may view agent fees as a factor that weakens an offer, potentially driving down commissions over time. Buyer Confusion Over Agreements: A New Hurdle Amid this backdrop of negotiation, another challenge has arisen for buyer agents: navigating the complexities of buyer agreements. Following the National Association of Realtors’ (NAR) recent settlement, these agreements have become mandatory before agents can show homes, causing confusion and concern among potential buyers. Redfin agents have reported instances where buyers are put off by lengthy, complicated agreements. In San Diego, agent Alex Galanis noted a case where a buyer was presented with a 12-page document from another agent before even meeting in person. “It was overwhelming for her,” Galanis said. “No one should have to make such a big decision without first getting to know their agent.” The confusion has led to canceled tours and hesitation from buyers wary of signing exclusive agreements. In response, some brokerages, including Redfin and Zillow, have introduced simpler, non-binding fee agreements to make the process more accessible. Who Pays the Commission? Sellers Are Asking More Questions As agents across the country grapple with these new realities, the fundamental question of “Who should pay?” has become a central conversation in real estate offices. While some sellers remain committed to offering buyer agents a commission, many are now more aware of their ability to negotiate — and even refuse to pay entirely. Blakely Minton, an agent in Philadelphia, remarked that she’s never seen sellers more engaged in discussions around buy-side compensation. “They’re asking more questions than ever,” Minton said, noting a significant shift in seller attitudes. This is particularly true in competitive markets, where offering a set commission could set a listing apart. In places like Los Angeles, agents like Gregory Eubanks find that most sellers are still opting to pay a buyer agent fee to remain competitive. Yet, some agents fear the long-term effects of this growing trend. D.C. agent Mary Bazargan warned that first-time homebuyers could face increasing disadvantages as sellers push more of the financial burden onto buyers. “When the market heats up, I think we’ll see more buyers paying their own agents, which could price out those already struggling to enter the market.” Flexibility is Key: Sellers Take Control While uncertainty reigns in some areas, agents in other regions are embracing the newfound flexibility. In Portland, agent Michelle Palmquist said sellers are thrilled to have more control over commission decisions. “They feel like they’re in the driver’s seat,” Palmquist shared, reflecting a sentiment that is becoming more widespread. Las Vegas agent Bret Jenny agreed, emphasizing that decisions around buyer agent compensation are often highly specific to individual listings. “It’s all price-specific and seller-specific,” Jenny noted, signaling that this growing flexibility could lead to a more customized approach to real estate transactions moving forward. Ultimately, the future of buyer agent compensation is as varied as the markets themselves. While some regions remain firmly entrenched in traditional practices, others are seeing the rules rewritten before their eyes. What remains clear is that real estate agents, buyers, and sellers alike must adapt to these changing dynamics — or risk being left behind.

Categories

- All Blogs (183)

- "Stranger Things" House For Sale (1)

- A Grand Slam in Urban Renewal: The Remarkable Transformation of Bush Stadium (1)

- Bill Gates' Xanadu 2.0: A Tour of the Billionaire's $130M Medina Mansion (1)

- Boxing Legend Oscar De La Hoya Lists Henderson Home for $20 Million (1)

- Cadence in Henderson Leads Las Vegas Valley in New Home Construction (1)

- Cryptocurrency and Blockchain (4)

- Escape to Luxury: Discover the Ultimate Mountain Retreat in Las Vegas (1)

- Escape to Your Own Fortress of Solitude: Nova Scotia's $11.5 Million Private Island Haven (1)

- Experience Exquisite Living at 1860 Hatfields Court, Henderson, NV 89044 (1)

- Experts Stunned by Las Vegas Luxury Summer Home Sales (1)

- Hollywood Comes to Vegas (1)

- Is 2024 the Year to Strike Gold in Las Vegas Real Estate? (1)

- Las Vegas Businesses Convert Vacant Offices to Save Costs (1)

- Las Vegas Has Eight Years of Land Left (1)

- Las Vegas Home Builders Experience Best First Quarter Since 2021 (1)

- Las Vegas Home Prices Soar: Median Price Hits $473,000, Closing in on All-Time Record (1)

- Las Vegas Homebuilding Boom: Top Companies Leading the Charge (1)

- Las Vegas Homeowner Takes on City Hall Over $180,000 Airbnb Fine, Alleging Violation of Due Process and Excessive Punishment (1)

- Las Vegas Housing Crisis: A Desert Mirage of Affordability (1)

- Las Vegas Housing Market Market Surge Continues (1)

- Las Vegas Luxury Real Estate: $35 Million Sale Sets New Record in The Summit Club (1)

- Las Vegas Population Explosion: How UNLV's 1996 Forecast Predicted Today's 2.4 Million Clark County Residents (1)

- Las Vegas Real Estate Market Insights: Top Trends, Home Buying Tips, and Best Neighborhoods (1)

- Las Vegas Real Estate Market Report: Homes Sell Fast in May 2024 (1)

- Las Vegas Real Estate Market Update (1)

- Las Vegas Real Estate Trends: Current Market Snapshot (1)

- Las Vegas Strikes Gold with Affluent Tourists and Residents: A Booming Tourism and Migration Report (1)

- Las Vegas Valley Sees Surge in Investor Home Purchases (1)

- Luxury Living in Las Vegas: SkyVu Unveils New Model Homes in MacDonald Highlands (1)

- Luxury Living in Las Vegas: The Ultimate High-Rise Experience (1)

- Market Update (1)

- Mesquite, Nevada: The Hidden Oasis Attracting Retirees and Reshaping the Silver State's Landscape (1)

- Newsletter (1)

- Pee-wee Herman's Iconic Los Feliz Home for Sale: $5 Million (1)

- Southwest Las Vegas Growth (1)

- Step into the Legendary Home of Jerry Lewis: A Piece of Hollywood History Hits the Market (1)

- Suze Orman's Tells Caller that $200K Savings Won't Cut It for Homeownership (1)

- The Canyon at Ascaya (1)

- The Dink Revolution: Pickleball Takes Over Las Vegas (1)

- The real ‘Full House’ house in San Francisco and where to find it (1)

- The Summit Club (1)

- The Treetop Revolution: How Luxury Treehouse Mansions Are Redefining the Skyline (1)

- Tropicana Las Vegas Demolition Preparing for Implosion to Make Way for MLB Stadium (1)

- Unearthed: The Hidden World of Luxury Cave Homes (1)

- Why the Surge in Construction Won't Lead to a Housing Market Crash (1)

Recent Posts